Companies that you expect to safeguard your private data suffer data breaches daily. Sensitive information, like social security numbers, credit card information, home addresses, birthdates, and more have even been leaked by credit bureaus like Equifax and from government agencies like Washington state’s Employment Security Department. I mention these two examples specifically because in their cases, you have little control over whether these agencies even have your data.

You can be picky about the companies you do business with. You can take good measures to protect your home network from hackers. However, your data could still end up as part of a data breach. Here are five ways to protect yourself.

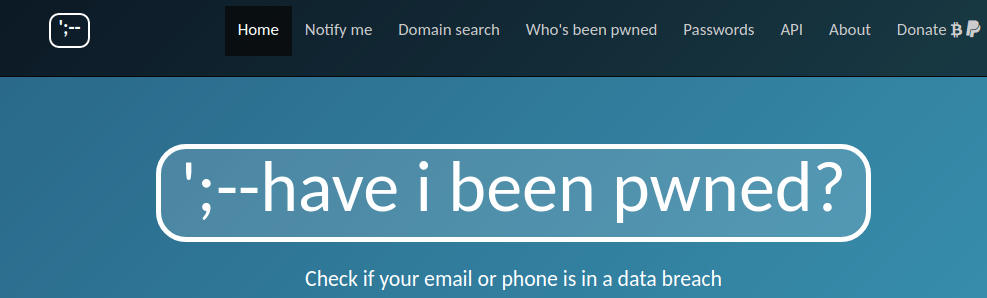

1. Sign up for Have I Been Pwned

Have I Been Pwned allows you to search across multiple data breaches to see if your information has been compromised. It can also alert you if your info is in future data breaches. Knowing that your data is part of a breach as soon as possible is critical to protecting yourself. You can quickly remove data, close accounts, and change passwords in response to data leaks.

2. Don’t reuse passwords

If your password is part of a data leak, then every other account where you use that password can potentially be compromised. Limit the damage of a password leak by always using unique passwords with every account.

I know it is hard to create dozens of strong and unique passwords. I highly recommend using a password manager like LastPass or Bitwarden.

3. Use multi-factor authentication

Multi-factor authentication generally describes security technologies and practices that require multiple methods of authentication in order to access a system. If a cybercriminal has your username and password they probably still won’t be able to access your account if you’ve enabled multi-factor authentication.

If a company offers multi-factor authentication you should use it. Read my article about multi-factor authentication methods if you want to learn more about this important security step.

4. Credit monitoring and account alerts

Knowing when your identity or accounts have been compromised as soon as possible is key to fixing the problem and limiting damage. Most financial services firms (banks, credit card companies, investment firms, etc.) allow you to set up alerts that will notify you when unusual activity is happening on your account.

Additionally, you can purchase credit monitoring from one of the credit bureaus. These services notify you whenever there are changes to your credit record. Be sure to take advantage of free offers from companies after you are the subject of data breaches if you don’t already have credit monitoring.

5. Keep your credit frozen or locked

You should assume that cybercriminals have already breached a company that you do or have done business with. Why? Because they probably have. Large companies have reported many data breaches over the years. But, how many haven’t been reported? What if a company doesn’t know cybercriminals breached them?

I believe it is safest to operate as if a bad actor already has your personal data. One way to combat this is to freeze or lock your credit. Cybercriminals can’t create new credit accounts (credit cards, bank loans, etc.) on a frozen or locked credit record. Even you can’t unless you unlock or unfreeze your credit record.

This may be an inconvenience when you want to open a legitimate credit account, but it is worth it to keep identity theft fraudsters at bay. Note that you should apply a freeze or lock to all three credit bureaus (Experian, Equifax, and Transunion) for this to be an effective tactic.

Editor’s note: Credit locks and credit freezes both restrict access to your credit report but they are different. The key differences are that credit freezes are free, but credit locks don’t have to be. Most credit bureaus make credit locks simpler to turn on and off than credit freezes. Lastly, federal law governs credit freezes and their protections. Credit locks don’t have the same oversight.

Final thoughts about protecting yourself from data breaches

Unfortunately, data breaches are a fact of life. Protecting yourself from them should be one of your highest cybersecurity priorities and a part of your personal cybersecurity practices. You should also look into these tips for securing your home network from hackers.

If you’d like to learn more about protecting yourself from data breaches, be sure to check out my book, The Personal Cybersecurity Manual. It will teach you how to protect yourself and your family from identity theft, fraud, and other cybercrimes.